OUR SERVICES

We provide a multi-domain one desk advisory service, spanning across Tax, Legal, Repatriation, Banking, Real Estate, DTAA, Valuation domains.

Transfer Funds

OUT of India

(15CA, 15CB Certificate)

Transfer your Funds out of India, without visiting India. Any Amount, Any Where. Funds received from Property Sale Proceeds, Inheritance, Gifts, Investments, Others. We can assist you with Tax & RBI Clearance, 15 CA, 15 CB Certification, Banking Compliance & more.

- 75% savings on Bank Charges*

- Lowest Fee in India

- Any Amount, Any Where

- End to End services

- Without going to India

Tax Exemption Certificate for NRI's, PIO's & OCI's

(for Property Sale in India)

You can save up-to 85% in Taxes (TDS), when selling property in India, in a legal way. Apply for a TDS Exemption Certificate anywhere in India, before you sell your property & also for rental income (TDS for NRI’s is 20% - 30% of sale Value, as per Section 195).

- 85% Tax Reduction*

- 50% DTAA Tax savings*

- Lowest Fee in India

- Guaranteed Certification

- Time bound, dependable

Power of Attorny (POA)

& Escrow Account

(Sell Property without going to India)

Sell your property, without going to India. Property Transaction Advisory (PTA) services, include NRI Tax, Property Law, Valuation, Repatriation of Funds from India, Corporate Broking and even DTAA assistance. Appoint a Corporate Power of Attorney, without visiting India.

- Corporate Power of Attorney

- Corporate Escrow Account

- 1 Desk Advisory

- 85% Tax savings*

- Without going to India

Property & Asset

Valuation

(Government Registered Valuer)

Right Value of your Property & your Assets before your Buy/Sell Transaction by Government Registered Valuer has a lot of advantages. Property Valuation for Capital Gains, Section 50, Partition, Inheritance, Net Worth, Visa, Joint Development Agreements, & Others.

- 15% better sale price*

- 30% Lower Tax*

- Lowest Fee in India

- Government Approved Certification

- Time bound, dependable

Overseas (Global)

Multi-Currency Account

(for Salary, Allotments, Inward & Outward)

Set up a Overseas (Global) Multi Currency Account for all your Inward and Outward Remittances and take the benefit of Corporate Forex Rates, which are best in the Industry, together with Private Banking & Investment Banking opportunities. Global Accounts for Global Citizens.

- Multi-Currency Accounts

- 35% better exchange rates*

- 75% Off on Bank Charges*

- Remote Assist for KYC

- 60% Lower Balance requirements

Will, Trust, Probate & Inheritance Planning

(Legacy Planning to secure Family)

With the uncertainty all around, it is advisable to get a Will done, to take care of your family members the way you would have wanted. We provide assistance for Corporate Executor, Administrator, Safe Deposit Lockers for storing Wills.

- 100% Tax Exemption

- 100% security for the family

- 85% Yearly Tax savings

- DTAA - Arm’s Length Compliance

- Professional, Compliant, Secure

NRI, OCI, Seafarer, Expat

Tax Returns & Tax Refunds

(Scrutiny Protect & DTAA)

Stay 100% compliant across countries without over-paying taxes. We have a record of less than 0.1% Scrutiny & Notice cases. 70% Clients get a Tax Refund, when they file with us, because of an excellent proprietary 5 stage process we follow, to file your Tax Returns.

- Income Tax Returns

- 70% of our Clients get Refunds

- Protection from Scrutiny

- Tax Planning & Savings

- Less than 0.1% Notice probability

Immigration Certification

Process Assistance

(Moving Overseas from India)

If you or your family members are moving overseas from India, you may need a few of our popular services. The services are provided on a PAN India basis and our professional expert advisors have been assisting Clients across 40+ Countries for the past many decades

- Net Worth Certificates

- Valuation of Assets (Govt. Approved)

- Overseas Account Set Up

- Funds Transfer Overseas

- 75% Off on Bank Charges*

Returning NRI (RNRI)

Tax Structuring & DTAA

(plan before you move to India)

Set up a Overseas (Global) Multi Currency Account for all your Inward and Outward Remittances and take the benefit of Corporate Forex Rates, which are best in the Industry, together with Private Banking & Investment Banking opportunities. Global Accounts for Global Citizens.

- 55% Yearly Tax Savings

- RNRI Tax & Investment Structuring

- DTAA, FA, FI, Structuring

- Remote Assist for Banking

- 40+ Years’ experience

Alfred Jordan Advantage

We build relationships that create value

Customer 1st

1 stop solution

Security

Trust

Values & Ethics

Peace-of-mind Guaranteed

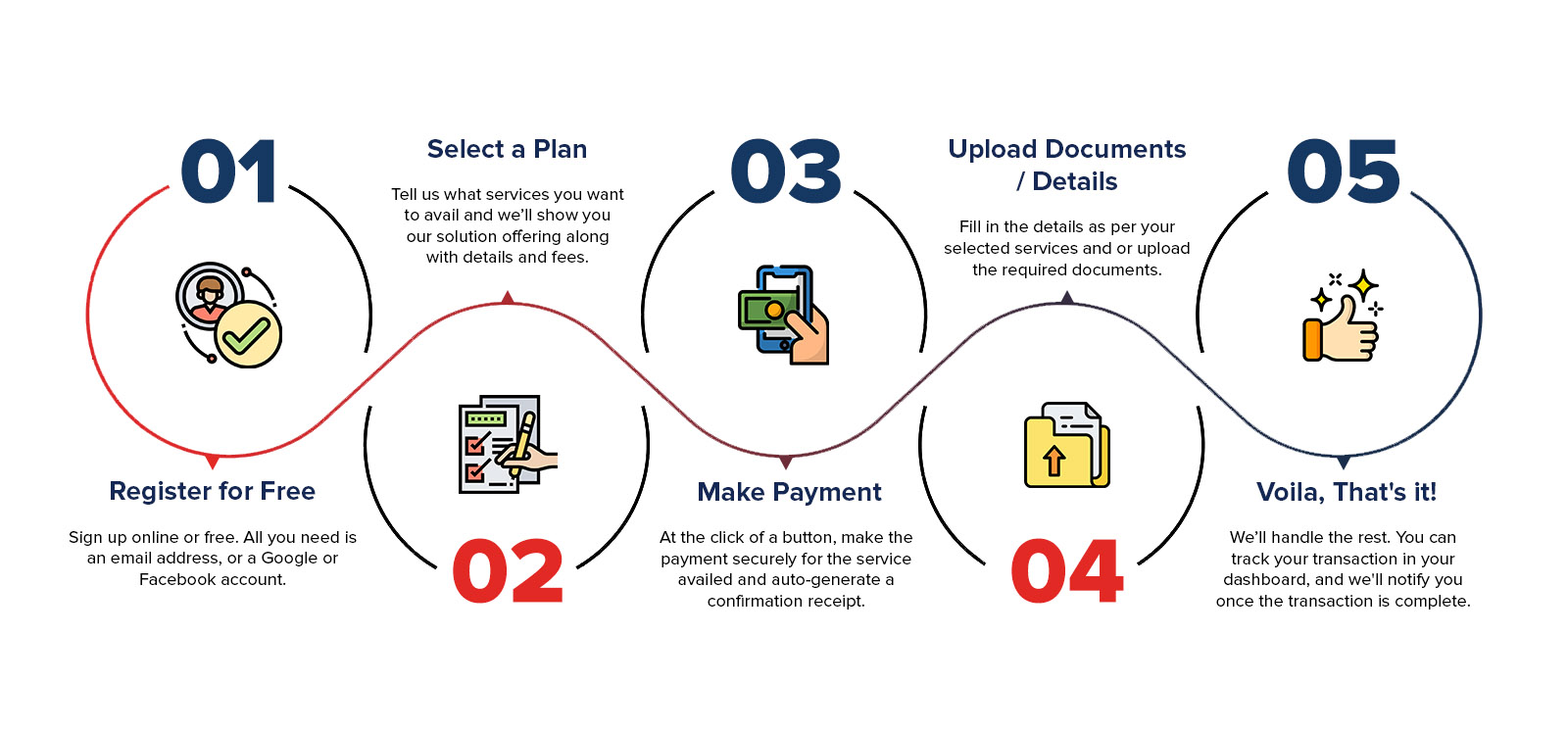

How it works

Tools and Resources

We provide a multi-domain one desk advisory service, spanning across Tax, Legal, Repatriation, iBanking, Real Estate, DTAA, Valuation domains

Calculators

Use our calculators to figure your tax and financial obligations.

Download Legal Agreement

Download Legal Agreement

Formats for Free usage

- 1000+ Legal Templates

- Free of Cost (Rs 1 only)

- Editable (Word or PDF)

- Ready to Use Agreements

- Assistance in Drafting

- Draft a Will

- Property Sale Agreement

- NRI Power of Attorney

Speak to an Advisor

(6 am to 11 pm IST

& even in between)

Got questions? We’ve got answers.

We are a Brick and Mortar firm and we like it the old way, where meeting and speaking to Clients, help us build a relationship.

Testimonials

First Class Support from real people

Find Out More

A team to support wherever you are.

- Bengaluru

- |

- Chennai

- |

- Delhi

- |

- Goa*

- |

- Hyderabad

- |

- Kolkata

- |

- Mumbai

- |

- Pune