Let us file your Tax, while you relax!

Express Instant Filing (Self)

Express Online (Semi - Assisted)

Offline (Fully Assisted)

Others

Get Started

| *COMPARE PLANS (Indicative Suitablity) | Express Online Basic | Express Online | Silver | Gold | Diamond | Platinum | Titanium | Customised |

|---|---|---|---|---|---|---|---|---|

| Pricing (INR Per Annum) | 1 | 2,500 | 5,000 | 10,000 | 20,000 | 40,000 | 80,000 | Customised |

| *You choose our fee. That's it. There's no

catch. For this service, you pay us what you decide we deserve and those fees will go towards our employees, day-to-day running expenses - from rent to developers to chai to servers etc. We trust you. Third Party, Out of pocket expenses, Fees, Taxes and Duties applicable on the Services, will be extra. |

||||||||

| Income Tax eFiling Package Description | Express Instant eFiling (DIY), Secure & safe | Express services with minimum documentation on E-mode & simplified filing suitable for Resident salaried individuals | Basic accounting & tax filing services with personalised attention & basic advisory | Standard accounting, tax filing & advisory services with personalised attention throughout the year | Premium services with full accounting, tax filing, advisory & tax support throughout the year | Premium personalised services with full accounting, tax filing, personal tax adivisor & support throughout the year | Premium personalised services with full accounting, tax filing, personal tax adivisor & support throughout the year | Customised services for specific issues & services with advisory |

| ? Pop Up Comments | Suitable for Low Transaction Bank Accounts & Vanila Investments | Suitable for Low Transaction Bank Accounts & Vanila Investments & Fresher Level | Suitable for Low Transaction Bank Accounts & Vanila Investments & Middle Level | Suitable for Low Transaction Bank Accounts & Multiple Investments, Multiple Properties & in the Middle Level | Suitable for Low Transaction Bank Accounts & Multiple Investments, Multiple Properties & in the Middle & Top Level | Suitable for Low Transaction Bank Accounts & Multiple Investments, Multiple Properties across Multiple Countries & in the Middle & Top Level | Suitable for Low Transaction Bank Accounts & Multiple Investments, Multiple Properties across Multiple Countries & in the Middle & Top Level | Customised as per specific requirements of Clients |

| Sources of Income | ||||||||

| Salary/Pension | Customised | |||||||

| Interest/Dividend Income (Deposits/Bank/Funds) | Customised | |||||||

| Loss from House Property (Loan) | Customised | |||||||

| Capital Gains from Investments | Customised | |||||||

| Income from House Property (Rental) | Customised | |||||||

| Income from Other Sources | Customised | |||||||

| Professional Income | Customised | |||||||

| Capital Gains/Loss from Share Trading | Customised | |||||||

| Overseas Income (Resident/NOR) | Customised | |||||||

| Foreign Assets (Resident/NOR) | Customised | |||||||

| Capital Gains from House Property | Customised | |||||||

| Business Income (Proprietorship/Partnership) | Customised | |||||||

| Tax, Legal, DTAA, Valuation & Advisory Services | ||||||||

| Inheritance Planning | Customised | |||||||

| Retirement Planning | Customised | |||||||

| Charity & Philanthropy | Customised | |||||||

| International Relocation | Customised | |||||||

| Start Ups & Company Incorporation | Customised | |||||||

| Estate Planning - Cross Border | Customised | |||||||

| Deeds & Agreements | Customised | |||||||

| Will & Probate Advisory | Customised | |||||||

| Forex & Financial Advisory | ||||||||

| Off Shore Accounts | Customised | |||||||

| 15 CA / 15 CB Certificate Advisory | Customised | |||||||

| Repatriation - Funds Transfer Advisory | Customised | |||||||

| Multi Currency Priority Account | Customised | |||||||

| Forex Management | Customised | |||||||

| Private Banking | Customised | |||||||

| Investment Banking | Customised | |||||||

| Loan Restructuring | Customised | |||||||

| Asset Insurance | Customised | |||||||

| Insurance Broking | Customised | |||||||

| Structural Investment Advisory | Customised | |||||||

| Tax Filer Status | ||||||||

| Individual | ||||||||

| Seafarer | Customised | |||||||

| NRI | Customised | |||||||

| NOR | Customised | |||||||

| Returning NRI | Customised | |||||||

| Expats | Customised | |||||||

| Other Than Individual | ||||||||

| HUF/Proprietorship/Partnership/LLP | Customised | |||||||

| Company (Private/Public Limited) | Customised | |||||||

| Foreign Company | Customised | |||||||

| Service Features | ||||||||

| Compliance | Customised | |||||||

| E Returns Filing | Customised | |||||||

| Assessment Protection / TDS Check | Customised | |||||||

| 24/7 Support | Customised | |||||||

| Tax Declaration Assistance (Salaried Employees) | Customised | |||||||

| Tax Planning Advisory (Following AY) | Customised | |||||||

| Tax Optimisation Advisory | Customised | |||||||

| ITRV Submission | Customised | |||||||

| Tax Refund Assistance | Customised | |||||||

| Tax Payment Assistance | Customised | |||||||

| True Value / Tax Assist Assured | Customised | |||||||

| Personalised Services | Customised | |||||||

| Dedicated Personal Advisor | Customised | |||||||

| CTC Analysis & Advisory | Customised | |||||||

| Independent Asset Advisory | Customised | |||||||

| DTAA / Repatriation Consulting | Customised | |||||||

| Asset & Tax Management Training | Customised | |||||||

| Exclusive Priviledge Access | Customised | |||||||

| Priority Processing | Customised | |||||||

| Law Protect / Advocate Advisory (Tax) | Customised | |||||||

| Expert Review | Customised | |||||||

| Revised Returns | Customised | |||||||

| Wealth Tax | Customised | |||||||

| Tax/Financial Optimisation Review | 1 Time | 2 Times | 4 Times | Customised | ||||

| Round the Year Tax Consultancy | 4 Times | 6 Times | 8 Times | Unlimited | Customised | |||

| Accounting | Basic | Standard | Premium | Premium | Customised | |||

| Tax Review (Previous Years) | 1 Years | 2 Years | 3 Years | 3 Years | Customised | |||

| Welcome Pack | Silver | Gold | Diamond | Platinum | Titanium | Customised | ||

| Archive Management | 1 Year | 1 Year | 2 Years | 3 Years | 3 Years | 3 Years | Customised | |

| Valuation Services# | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing |

| Legal Services# | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing |

| Buy Now | Buy Now | Buy Now | Buy Now | Buy Now | Buy Now | Buy Now | Buy Now | |

| * The comparison chart for various plans is indicative only and may differ on a case to case basis. The classification of services in a Plan does not necessary mean that each and every or all the services will be provided which have been listed under that particular plan. Keeping in mind the varied differences in documents and documentation for tax filers it is not possible to enumerate or determine the specific time or effort required to complete a given task hence it is not possible to exactly specify the nature or quality or quantity of specific services, hence we shall not be liable or penalised or requested for a refund in whatsoever manner if any of the abover services are not provided in that specific plan. This chart is on a best effort basis and the services enumerated are also on a best effort basis. | ||||||||

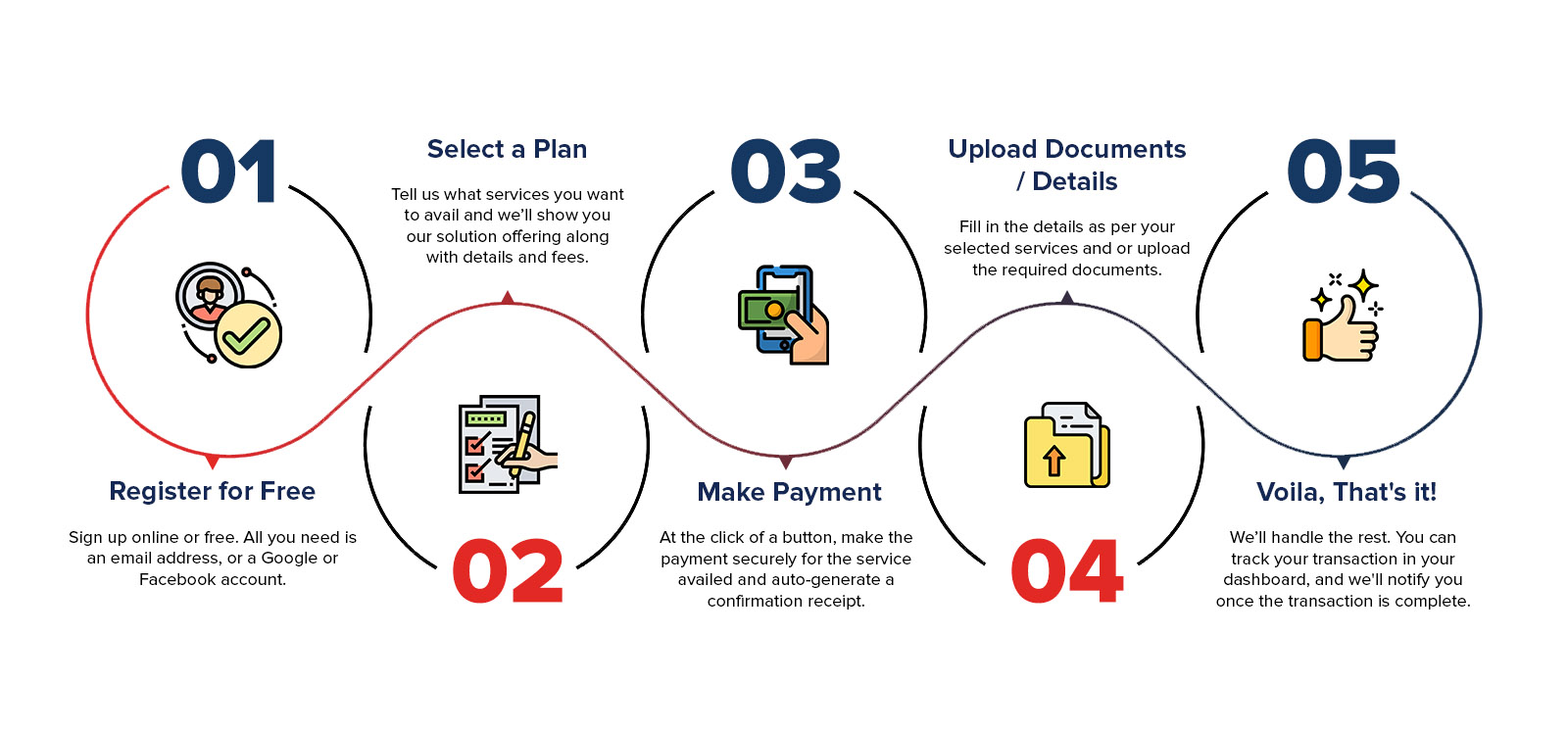

How it works

Help & Guide Corner

If you are an NRI or Seafarer and you DONOT have Property, Investments in India, then you may not need to file your Tax Returns in India. However, if you have Properties, Investments, in India, you may need to file your Tax Returns. Generally, we see that 80% of our NRI Clients, get a Tax Refund in India, when they file their Tax Returns, and moreover a proper compliance is also maintained by filing Tax Returns.

Moreover, if at anytime you plan to return to India, then these Tax Returns filed over the past many years will hold you in good stead if there is any Income Tax Notice on the source of funds.

There are 2 ways to file your tax returns in India. The perfect and correct way, and the not so perfect and incorrect way. Filing your Tax Returns the perfect way and correct way will require a little extra effort in terms of documentation and capturing the facts and figures, where you will need to collate figures for the financial year under specified heads. The primary heads that needs to be declared are as follows:

Income and Expenses

Assets and Liabilities

Income and Expenses

Assets and Liabilities

Form 26AS has become one of the most important compliance documents in the past few years. The Form 26AS was a simplified summation of the TDS (with-holding taxes) from various Banks, Employers, and others who had made payments to you. However, in the last few years, many transactions have come under compliance and reflect in the 26AS which need to be accounted for in your Tax Returns in India.

There are multiple ITR Forms, which depend on your which source of income you have. It is important to select the right ITR Form to file your tax returns in India, else your returns may get rejected.

A Trust has a separate returns format vis a vis a Company.