Property Transaction Advisory (PTA)

One Desk assistance for Property Tax | Law | DTAA | Repatriation| Valuation (Government Approved). Pioneered Remote Service Features, get all your work done without coming to India.

Property Transaction Advisory

NIL TDS

Certificate

Property Sale & Repatriation

Property

Valuation

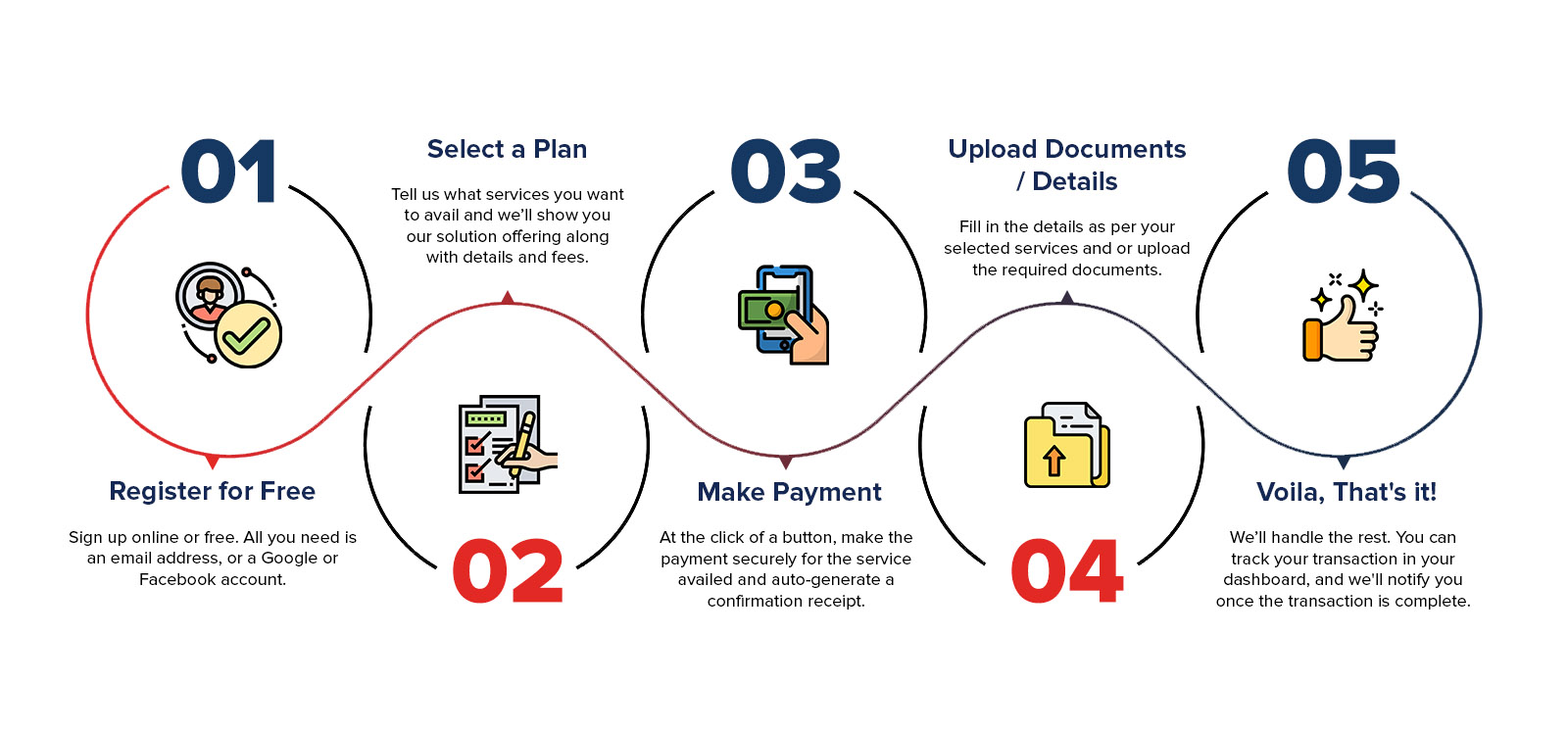

Get started or choose a plan

| *COMPARE PLANS (Indicative Suitablity) | Basic | Express | Silver | Gold | End to End | Premium | Customised |

|---|---|---|---|---|---|---|---|

| Pricing (INR Per Transaction) | 1000 | 2500 | 5000 | 10000 | 20000 | 40000 | Customised |

| Third Party, Out of pocket expenses, Fees, Taxes and Duties applicable on the Services, will be extra. | |||||||

| Remittance Package Description | Advisory Services for Remittance Planning | Certifications and Documentation for Select Locations | Get your Tax Clearance Certificates with Basic Documentation from anywhere in the World. Express services with minimum documentation on E-mode. | Get your Tax Clearance Certificates Door Delivered, with Basic Documentation from anywhere in the World. We are available for any queries & Assistance. | Full Service - End to end Certification, Documentation & Transfer. Its our resposibility till you receive the Funds in your overseas Account, else 100% Cash Back. | Tax, RBI Approval & Clearance with End to end Certification, Documentation & Transfer assistance. | Customised services for specific issues & services with advisory. |

| ? Pop Up | Suitable for Remittance from Rs 0-2Cr where you need only 1-time advisory. | Suitable for Remittance from Rs 0-1Cr where you donot need any advisory and only the Certificates. Rest, you will take care of. | Suitable for Remittance from Rs 0-2Cr where you donot need any advisory and only the Certificates. Rest, you will take care of. | Suitable for Remittance from Rs 0-5 Cr where you would prefer priority services, advisory and the Certificates. | Suitable for Remittance from Rs 0-5 Cr where our Team will take care of everything end-to-end, including Certifications. We will be responsible for entire process, till you get the funds repatriated, without your physical presence in India. | Suitable for Remittance from Rs 0-10 Cr where our Team will take care of everything end-to-end, including Certifications, RBI & Tax Clearances. We may be responsible for entire process, till you get the funds repatriated, without your physical presence in India. | Suitable for Remittance from Rs 5 Cr + where our Team will take care of everything end-to-end, including Certifications. We will be responsible for entire process, till you get the funds repatriated, without your physical presence in India. |

| Compliances & Documentation | |||||||

| Document Verification | Advisory | Customised | |||||

| Tax Computation & Clearance (Internal) | Advisory | Customised | |||||

| Tax Compliance | Advisory | Customised | |||||

| Authorised Dealer Document Compliance | Advisory | Customised | |||||

| Advisory & Certifications | |||||||

| Certification (15 CA / 15 CB) | Advisory | Customised | |||||

| Off Shore Accounts | Advisory | Customised | |||||

| Multi Currency Priority Account | Advisory | Customised | |||||

| Forex Management | Advisory | Customised | |||||

| CA & Other Certifications | Advisory | Customised | |||||

| Document Rectification | Advisory | Customised | |||||

| Remittance Documentation & mediation | Advisory | Customised | |||||

| Objection handling & Liasioning | Advisory | Customised | |||||

| Rectification & Remittance | Advisory | Customised | |||||

| RBI or Income Tax Clearance & Certification | Advisory | Customised | |||||

| Service Features | |||||||

| 24/7 Support | Customised | ||||||

| Senior Citizen Advisor | Customised | ||||||

| Dedicated Personal Advisor | Customised | ||||||

| Preferential Fex Rate* | Customised | ||||||

| Off Shore Accounts | Customised | ||||||

| Multi Currency Priority Account | Customised | ||||||

| Forex Management | Customised | ||||||

| Priority Processing | Customised | ||||||

| Door-Step document dilevery* | Customised | ||||||

| Tax Payment Assistance | Customised | ||||||

| Scrutiny Protect / Advocate Advisory (Tax) | Customised | ||||||

| Personalised Services | Customised | ||||||

| DTAA / Repatriation Consulting | Customised | ||||||

| Tax Services# | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing |

| Valuation Services# | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing |

| Legal Services# | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing |

| #Legal Services is provided by M/s Law Masters & Valuation by M/s Right Value | |||||||

| * TnC Apply; Nationalised & Upcountry Banks may be charged extra. | |||||||

| Tax Filer Status | |||||||

| Individual | |||||||

| Resident Salaried | Customised | ||||||

| Resident Professional | Customised | ||||||

| Seafarer | Customised | ||||||

| NRI | Customised | ||||||

| NOR | Customised | ||||||

| Returning NRI | Customised | ||||||

| Expats | Customised | ||||||

| Other Than Individual | |||||||

| HUF/Proprietorship/Partnership/LLP | Customised | ||||||

| Company (Private/Public Limited) | Customised | ||||||

| Foreign Company | Customised | ||||||

| Pay Now | Pay Now | Pay Now | Pay Now | Pay Now | Pay Now | Pay Now | |

| * The comparison chart for various plans is indicative only and may differ on a case to case basis. The classification of services in a Plan does not necessary mean that each and every or all the services will be provided which have been listed under that particular plan. Keeping in mind the varied differences in documents and documentation for tax filers it is not possible to enumerate or determine the specific time or effort required to complete a given task hence it is not possible to exactly specify the nature or quality or quantity of specific services, hence we shall not be liable or penalised or requested for a refund in whatsoever manner if any of the abover services are not provided in that specific plan. This chart is on a best effort basis and the services enumerated are also on a best effort basis. | |||||||

Help & Guide Corner

Property transactions in India have always been a little complicated with many pitfalls. The cumbersome legal process, the tax implications, double tax avoidance, fair valuation, negotiation and documentation, and finally repatriation of funds after a property sale, its quite a few steps and many micro steps and surprises in between.

We provide the facility of a corporate POA (Power of Attorney), where the organization representative can be appointed a POA for your Property Purchase transaction in India or the Property Sale transaction in India. Hence, you will not be required to come to India at all for the buy/sell transaction.

As the organization and its representative is taking the POA, its absolutely safe and secure, vis a vis an individual POA, and your entire transaction can be executed without you having to visit India.

"When you want to repatriate funds from India, ie: send money outside India, you will need multiple documents, and certification, depending on the source of funds or the quantum. Form A2 is one of the Forms and documents that is required for executing the overseas transfer of funds.

The primary format of A2 is specified by the RBI, however, each bank has adapted the format to suit its requirements. Moreover the format keeps changing once in a while with the ever changing legal landscape for cross border transactions.