We help you stay 100% Tax and legal compliant when moving countries. A One Desk, end2end RNRI Help Desk to take care of your requirements in India and abroad.

Family office (My CFO)

Tax filing

Overseas Multi-currency Account

Get started or choose a plan

Gold

20000

Advisory & Compliance in India (Tax | Repatriation | Valuation). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios.

Diamond

40000

Advisory & Compliance in India (Tax | Repatriation | Valuation | Banking). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios and Properties.

Platinum

80000

Full Service Advisory & Compliance in India (Tax | Legal | DTAA | Repatriation | Valuation | Banking). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios and Properties.

Titanium

160000

Premium Service Advisory & Compliance in India (Tax | Legal | DTAA | Repatriation | Valuation | Banking). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios, Properties and Non Vanilla investments.

Priority

320000

Premium Service Advisory & Compliance in India (Tax | Legal | DTAA | Repatriation | Valuation | Banking). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios, Properties and Non Vanilla investments.

| *COMPARE PLANS (Indicative Suitablity) | Diamond | Platinum | Titanium | Priority | Private | Customised |

|---|---|---|---|---|---|---|

| Pricing (INR Per Annum) | 20,000.00 | 40,000.00 | 80,000.00 | 160,000.00 | 320,000.00 | Customised |

| Third Party, Out of pocket expenses, Fees, Taxes and Duties applicable on the Services, will be extra. | ||||||

| Plan Description | Advisory & Compliance in India (Tax | Repatriation | Valuation). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios. | Advisory & Compliance in India (Tax | Repatriation | Valuation | Banking). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios and Properties. | Full Service Advisory & Compliance in India (Tax | Legal | DTAA | Repatriation | Valuation | Banking). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios and Properties. | Premium Service Advisory & Compliance in India (Tax | Legal | DTAA | Repatriation | Valuation | Banking). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios, Properties and Non Vanilla investments. | Premium Service Advisory & Compliance in India (Tax | Legal | DTAA | Repatriation | Valuation | Banking). Suitable for Global Citizens who have Investments in multiple Countries, and have multiple Portfolios, Properties and Non Vanilla investments. | Customised services for specific issues & services with advisory. |

| Net Worth (Cr) | 0-5 | 0-10 | 0-15 | 0-20 | 20 and Above | Customised |

| Servicing Requirement | One Time | Half Yearly | Quarterly | Unlimited | Unlimited | Customised |

| Geographic Exposure (Forex, Investment, Property) | 1-2 Countries | 1-2 Countries | 1-5 Countries | Unlimited | Unlimited | Customised |

| Asset Class | Financial Assets | Financial Assets, Real Estate | Financial Assets, Real Estate, Structures | Unlimited | Unlimited | Customised |

| Tax & Compliance | ||||||

| Income Tax Returns | Customised | |||||

| TDS Returns & Advisory | Customised | |||||

| IT Refund/Notice Advisory | Customised | |||||

| Income Tax Advisory | Customised | |||||

| NRI Status Advisory | Customised | |||||

| Compliance | Customised | |||||

| Capital Gains Advisory | Customised | |||||

| 15 CA 15 CB Certifications | Customised | |||||

| Trust & Succession Planning | Customised | |||||

| Accounting & Book-keeping | Customised | |||||

| DTAA Advisory | Customised | |||||

| FATCA & FBAR | Customised | |||||

| Start Up Advisory | Customised | |||||

| International Tax Planning | Customised | |||||

| Audit Assistance | Customised | |||||

| FEMA Advisory | Customised | |||||

| RBI & IT Certification | Customised | |||||

| Risk Management | ||||||

| Performance Management & Benchmarking | ||||||

| Tax, Legal, DTAA, Valuation & Advisory Services | ||||||

| Inheritance Planning | Customised | |||||

| Retirement Planning | Customised | |||||

| Charity & Philanthropy | Customised | |||||

| International Relocation | Customised | |||||

| Start Ups & Company Incorporation | Customised | |||||

| Estate Planning - Cross Border | Customised | |||||

| Deeds & Agreements | Customised | |||||

| Will & Probate Advisory | Customised | |||||

| Forex & Financial Advisory | ||||||

| Off Shore Accounts | Customised | |||||

| Multi Currency Priority Account | Customised | |||||

| Forex Management | Customised | |||||

| Private Banking | Customised | |||||

| Investment Banking | Customised | |||||

| Loan Restructuring | Customised | |||||

| Asset Insurance | Customised | |||||

| Insurance Broking | Customised | |||||

| Structural Investment Advisory | Customised | |||||

| Property Transaction Advisory (Tax | Law | DTAA | Repatriation | Valuation) | ||||||

| Indicative Property Value | 0 - 1 Cr | 0 - 2 Cr | 0 - 5 Cr | 0 - 10 Cr | 10 Cr + | |

| Tax Advisory & Assistance | ||||||

| Tax Returns, Tax Refund & Tax Notice | Customised | |||||

| Capital Gain Advisory | Customised | |||||

| Tax Saving Investment | Customised | |||||

| Tax Payment Assistance | Customised | |||||

| DTAA & Cross Border Tax Compliance | ||||||

| DTAA - Cross Border Tax Planning | Customised | |||||

| TP, IT, FEMA, FATCA, FBAR, CRS & Others | Customised | |||||

| US, UK, Sing Tax Returns | Customised | |||||

| TDS for NRI's | ||||||

| TDS Computation & Advisory | Customised | |||||

| TDS Returns & Form 16 A, 16B | Customised | |||||

| PAN / TAN Application | Customised | |||||

| NIL TDS Certificate for Property Sale (Sec 195) | Customised | |||||

| NIL TDS Certificate for Property Rent | Customised | |||||

| Repatriation & Forex Advisory | ||||||

| 15 CA / 15 CB Certificate | Customised | |||||

| Repatriation - Funds Transfer | Customised | |||||

| Off Shore Accounts | Customised | |||||

| Multi Currency Priority Account | Customised | |||||

| Forex Management | Customised | |||||

| RBI & IT Clearances | Customised | |||||

| Valuation Assistance (Government Approved Valuer) | ||||||

| Fair Market Valuation | Customised | |||||

| Capital Gains Valuation | Customised | |||||

| Sec 50 & 56 Valuation | Customised | |||||

| Legal Advisory & Assistance - XXXXXXXXXXXXXXXXX | ||||||

| Property Sale / Purchase without POA | 1%* | 1%* | 1%* | 1%* | 1%* | Customised |

| Property Sale / Purchase with POA | 1.25%* | 1.25%* | 1.25%* | 1.25%* | 1.25%* | Customised |

| NRI POA (Power of Attorney) - Sale | 0.5%* | 0.5%* | 0.5%* | 0.5%* | 0.5%* | Customised |

| NRI POA (Power of Attorney) - Purchase | 40k | 40k | 40k | 40k | 40k | Customised |

| Concirege Services | ||||||

| Virtual Office | Customised | |||||

| Secretarial Services | Customised | |||||

| Document Management | Customised | |||||

| Locker (Fire Safe) | Customised | |||||

| Tax Filer Status | ||||||

| Individual | ||||||

| Resident Salaried | Customised | |||||

| Resident Professionals | Customised | |||||

| Seafarer | Customised | |||||

| NRI | Customised | |||||

| NOR | Customised | |||||

| Returning NRI | Customised | |||||

| Expats | Customised | |||||

| Other Than Individual | ||||||

| HUF/Proprietorship/Partnership/LLP | Customised | |||||

| Company (Private/Public Limited) | Customised | |||||

| Foreign Company | Customised | |||||

| Service Features | ||||||

| 24/7 Support | Customised | |||||

| Senior Citizen Advisor | Customised | |||||

| Dedicated Personal Advisor | Customised | |||||

| Personalised Services | Customised | |||||

| Priority Processing | Customised | |||||

| Law Protect / Advocate Advisory (Tax) | Customised | |||||

| Round the Year Tax Consultancy | 4 Times | 8 Times | Unlimited | Customised | ||

| Accounting | Standard | Premium | Premium | Customised | ||

| Valuation Services# | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing |

| Legal Services# | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing | Prefrential Pricing |

| #Legal Services is provided by M/s Law Masters & Valuation by M/s Right Value | ||||||

| Pay Now | Pay Now | Pay Now | Pay Now | Pay Now | ||

| *The comparison chart for various plans is indicative only and may differ on a case to case basis. The classification of services in a Plan does not necessary mean that each and every or all the services will be provided which have been listed under that particular plan. Keeping in mind the varied differences in documents and documentation for tax filers it is not possible to enumerate or determine the specific time or effort required to complete a given task hence it is not possible to exactly specify the nature or quality or quantity of specific services, hence we shall not be liable or penalised or requested for a refund in whatsoever manner if any of the abover services are not provided in that specific plan. This chart is on a best effort basis and the services enumerated are also on a best effort basis. | ||||||

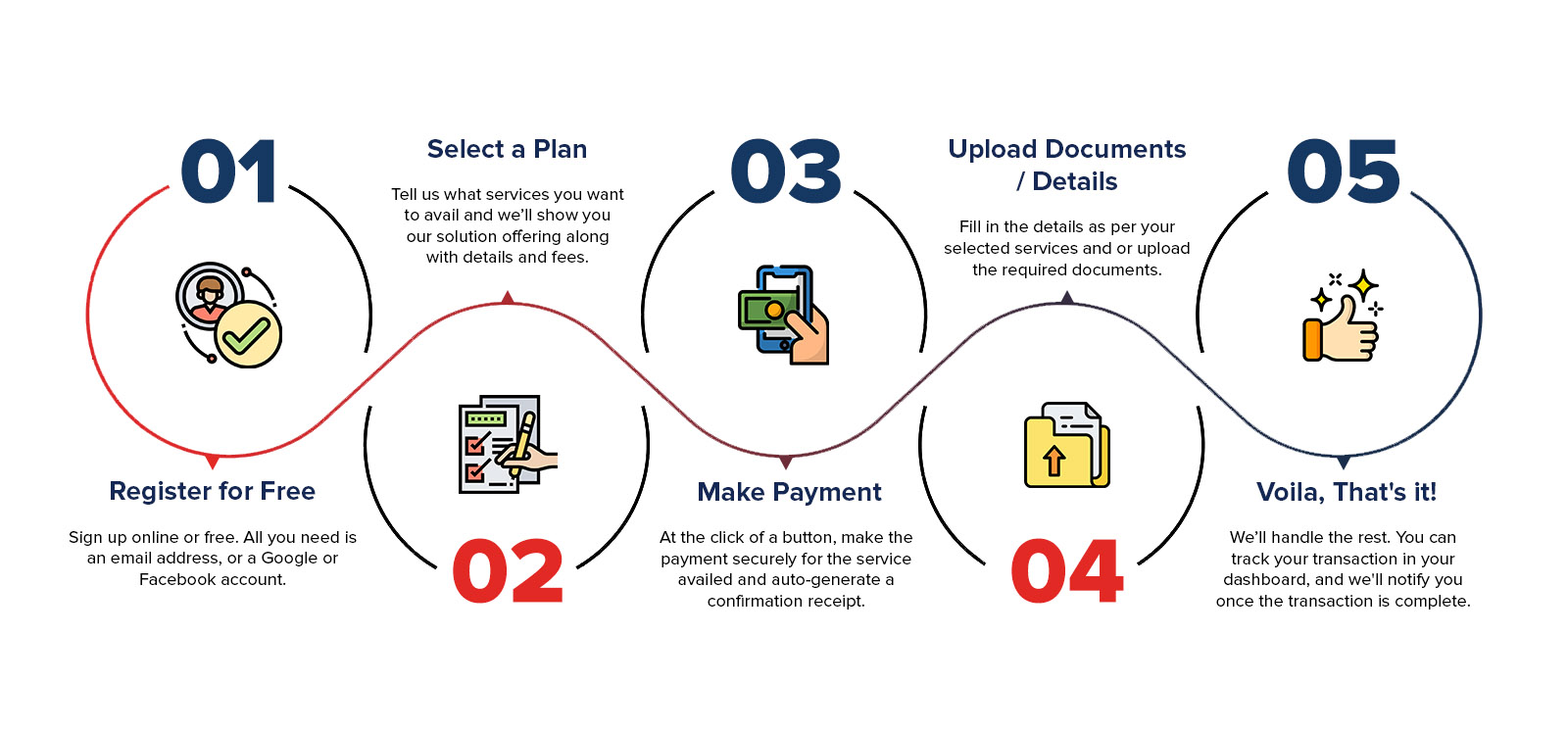

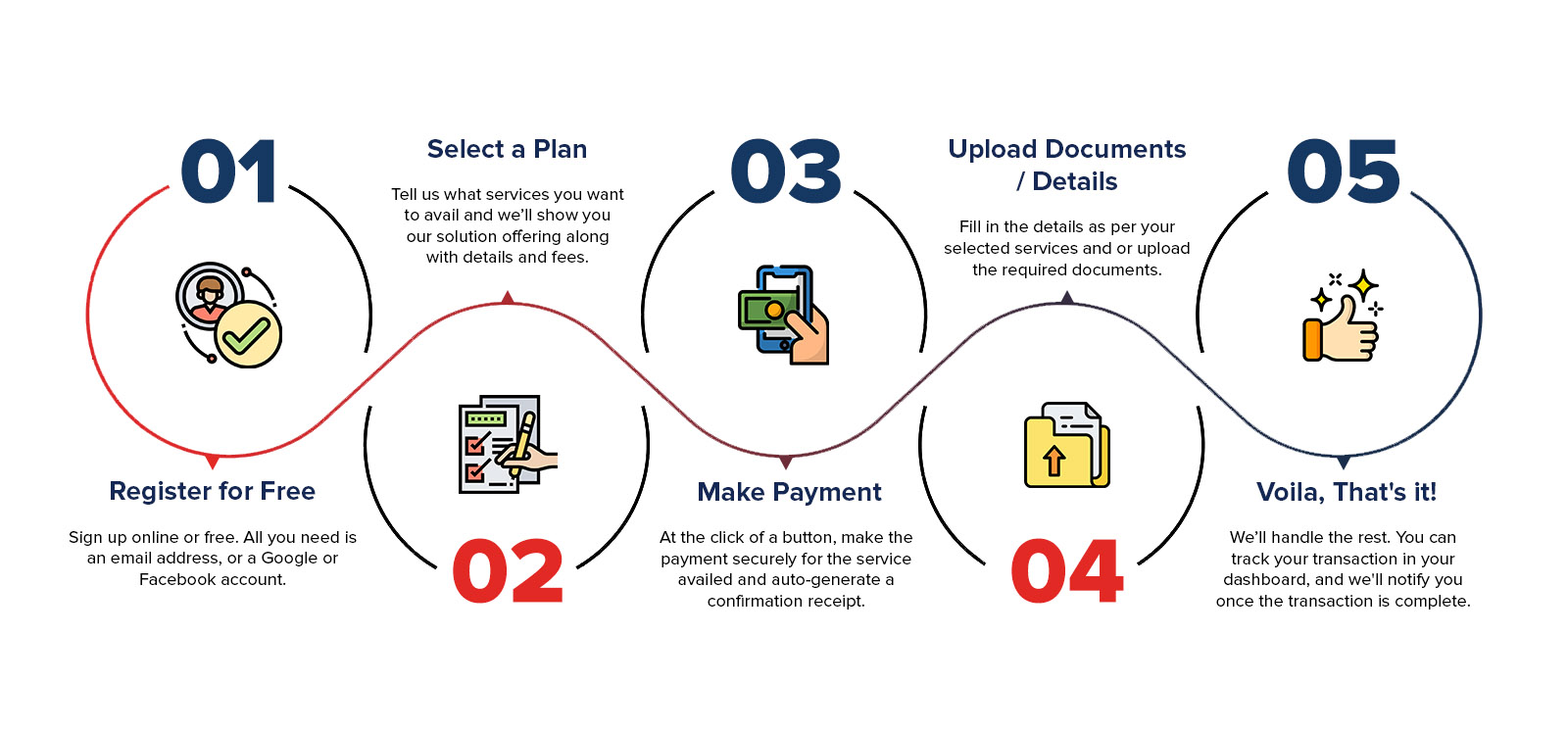

How it works

How it works

Help & Guide Corner

What is Double Tax Avoidance Agreement (DTAA) and what benefits are applicable?

NRI’s and Returning NRI’s can take a humongous amount of tax benefit on the basis of the Double Tax Avoidance Agreements (DTAA) between India and their current country of residence. It is very important to plan out your taxation, before your transaction or before relocating to India. DTAA provides a safety net from double taxation, wherein for a specific income, you will not be taxed twice in both the countries separately. The general principles of DTAA is that, depending on your residency, and source of income, you will need to pay tax in one country only, or at most pay only the differential tax amount (in case one country’s tax rate is higher than the other).

Does a Returning NRI need to file Income Tax Returns in India?

Returning NRI’s are either NRI's or NOR for tax purposes but will become a permanent residing in India once tahy are back. Hence, Returning NRI Taxations is a little different compared to NRI Taxation or Resident Taxation.

If an RNRI has any investments or properties in India, we advise them that it is generally required to file tax returns in India for a couple of back years.

Once he files his Tax Returns in India all his investments, properties, are declared in India, and compliant with global laws. Then, there may be lesser questions asked once you transfer all your savings, retirement funds to India.

I have decided to return to India. When should I start the process?

Ideally you should start the Tax Filing and Compliance process in India ,uch before you come back to India. This pre planing and restructuring will help you from a Tax point of view as well as from a Financial planning point of view and help you save unnecessary taxes.